A U.s. Federal Government Budget Surplus Occurs When

Mary McMahon Date. When the federal government spends more money than it receives in taxes in a given year it runs a budget deficit.

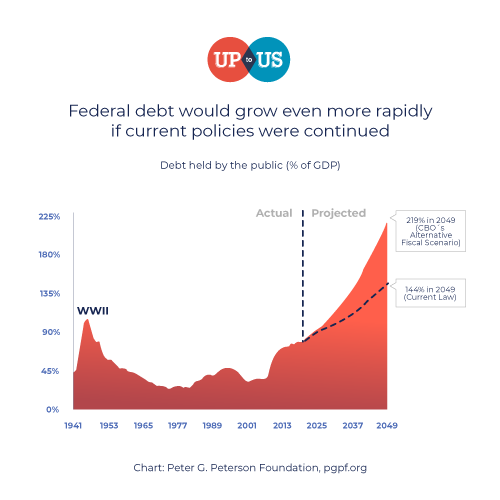

Federal Budget Breaking Down The Us Federal Budget Charts And Graphs

Government revenue exceeds outlays.

. The deficit or surplus in the federal governments budget if the economy were at potential GDP. Cyclically adjusted budget deficit or surplus - Cyclically adjusted budget deficit or surplus. March 16 2022 A budget surplus occurs when income is greater than spending.

Government revenue exceeds outlays. Suppose that over the past 50 years the nominal and real deficit of a country grew from 100 billion to 200 billion. Chapter 10 A budget deficit occurs when tax revenues do not cover government spending.

The opposite of a budget deficit a budget surplus occurs when the governments revenue exceeds current expenditures resulting in an excess of money that can be used as needed. Because tax revenues are projected based on expected national income and not known for each year achieving a balanced budget is nearly impossible for the federal government. Government outlays exceed revenue.

A surplus occurs when the government collects more money than it spends. B-raises taxes to finance a budget deficit. If government spending and taxes are equal it is said to have a balanced budget.

A budget surplus occurs when income exceeds expenditures. Government outlays equal revenue. D-borrows by selling bonds to finance a deficit.

Federal government budget deficit occurs when. Budget surpluses are not necessarily bad or good but prolonged periods of surpluses or deficits can cause significant problems. Suppose that over the same time real GDP grew from 100 billion to 300 billion.

The United States borrows money from foreign countries. The United States lends money to foreign countries. A federal budget surplus.

This has only happened a few times in US. The last surplus for the federal government was in 2001. A surplus occurs if the total value of receipts exceeds the value of outlays and a deficit occurs when the value of outlays exceeds the value of receipts.

When people organizations or governments have a budget surplus this means that they have extra funds which can be used to do things like retiring debt. A budget surplus occurs when tax revenues exceed government spending. A budget surplus occurs when government brings in more from taxation than it spends.

A balanced budget occurs when the amount the government spends equals the amount the government collects. Occurs when tax revenues exceed government expenditures. There is a surplus budget if tax receipts exceed spending by the government.

Fiscal policy refers to. All values are reported in millions of US. Government spending covers a range of services provided by the federal state and local governments.

A budget surplus is a situation in which revenue is more than spending or income is more than the expenses in a given period like a fiscal year or a financial quarter. When the federal government spends more money than it receives in taxes in a given year it runs a budget deficit. A budget deficit occurs when the federal government spends more money that it collects in revenue.

A surplus occurs when the government collects more money than it spends. A budget surplus occurs when income is greater than spending. The United States lends money to foreign countries.

History and not since 2000. Occurs when government expenditures exceed tax revenues. The United States borrows money from foreign countries.

Budget Surplus This occurs when tax revenue exceeds government spending. Economics questions and answers. Is under the direct control of congress.

When the government has a budget surplus. Budget surpluses are not always beneficial as they can create deflation and economic growth. Tax revenues or receipts are the money a government collects through a tax.

Crowding out occurs when the federal government. - A budget surplus occurs when the governments expenditures are less than its tax revenue. A budget surplus occurs when tax revenues are greater than federal spending for the year.

A federal budget surplus occurs when government expenditures exceed tax revenues. If the government takes in more money than it spends the excess is called a surplus. The last surplus for the federal government was in 2001.

A balanced budget occurs when the amount the government spends equals the amount the government collects. Federal government budget surplus occurs when A. Corporate income taxes are taxes paid by.

Government has run a multibillion-dollar deficit almost every year in modern history spending much more than it takes in. A budget of this nature can be useful if inflation persists or the overall output exceeds its level of aggregate demand. A budget surplus is more beneficial to a government.

A federal government would have budget surpluses if total tax revenues are more than the government spending. As a result the shortfall budget causes aggregate demand to fall. It is having more income than the expenditure during a specific period.

A budget surplus is when extra money is left over in a budget after expenses are paid. C-uses a budget surplus to pay off part of the national debt. Conversely when the government receives more money in taxes than it spends in a year it runs a budget surplus.

A federal budget deficit. Government outlays exceed revenue. The deficit is financed by the sale of Treasury securities bonds notes and bills which the government pays back with interest.

Government outlays equal revenue. This is federal spending that is included in a budget if Congress wishes. A payroll tax also known as social insurance tax is a tax on the wages of workers.

Changes in government expenditures and taxation to achieve particular economic goals. It is rarer than a unicorn. Money flowing into the Treasury is known as receipts and money flowing out is known as outlays.

Federal Government Budget Surplus Or Deficit M318501a027nbea Fred St Louis Fed

No comments for "A U.s. Federal Government Budget Surplus Occurs When"

Post a Comment